Understanding credit cycles can transform how you approach investing, offering a roadmap through economic turbulence.

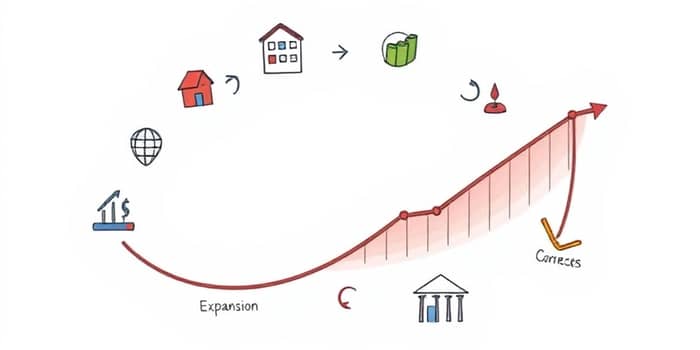

These cycles describe cyclical fluctuations in credit availability, influencing everything from interest rates to asset prices.

By recognizing their phases, investors can anticipate market shifts and make informed decisions.

Credit cycles are integral to the economy, often longer, deeper, and sharper than business cycles.

They amplify business cycles, making expansions stronger and recessions more severe.

Key drivers include risk appetite, liquidity, and borrowing behaviors across sectors.

For instance, loose credit can fuel asset bubbles, while tightening may trigger crises.

Different models help break down credit cycles into manageable phases.

The PrepNuggets simple model uses two main stages.

For a more detailed view, the Loomis Sayles framework outlines four phases.

This table provides a clear guide for navigating each stage.

Credit and business cycles are deeply interconnected, often fueling economic expansions together.

When aligned, they can lead to excessive credit growth and subsequent downturns.

Key indicators help track these relationships.

Policymakers use tools like macroprudential policies to smooth cycles.

History offers valuable lessons on credit cycle impacts.

The dot-com bubble to the global financial crisis spanned one credit cycle.

The 2008-2009 crisis showed how loose private credit can create housing bubbles.

Japan's 1980s-1990s experience highlighted the dangers of lax policies.

These examples underscore the general pattern of booms and busts.

Savvy investors use credit cycle stages to guide top-down decisions.

Each phase suggests different asset preferences and strategies.

Ray Dalio views these cycles as key wealth and power drivers.

Currently, we may be in a mid-expansion phase with growth potential.

Theoretical perspectives enrich our understanding of credit cycles.

Post-Keynesians and Austrians see credit as a fundamental driver.

Risks include human factors like fear and greed, which can inflate cycles.

Procyclical banks and shadow banking add complexity in late cycles.

Metrics for analysis are crucial for investors.

Policy tools, such as anti-cyclical buffers, help curb excessive booms.

By integrating these insights, you can build a resilient investment approach.

Credit cycles offer a framework for anticipating economic shifts.

Embrace this knowledge to navigate markets with confidence and clarity.

References