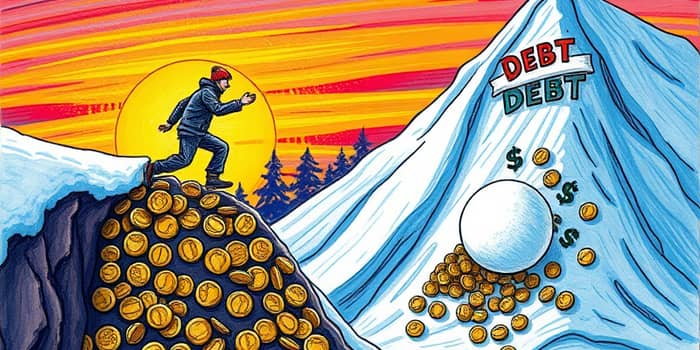

Debt can feel like a heavy chain, limiting your financial dreams and causing daily stress.

But with the right strategy, you can break free and build a brighter future.

The Debt Snowball and Avalanche methods offer powerful, proven paths to eliminate debt step by step.

Understanding these approaches can transform your financial journey from overwhelming to empowering.

This guide will walk you through everything you need to know to take control.

Let's start by exploring what makes each method unique and effective.

The Debt Snowball method focuses on psychological wins to keep you motivated.

You begin by listing all your debts from smallest to largest balance.

This approach ignores interest rates, prioritizing quick progress over mathematical efficiency.

Here are the key steps to implement the Debt Snowball method effectively.

This method is celebrated for its immediate sense of achievement, which can fuel ongoing commitment.

By clearing smaller debts quickly, you build confidence and reduce the number of accounts you manage.

It's a strategy that taps into human psychology, making debt repayment feel more manageable and rewarding.

The Debt Avalanche method takes a mathematically driven approach to save money on interest.

You start by listing debts from highest to lowest interest rate, regardless of balance.

This strategy aims to minimize the total interest paid over time, optimizing your financial resources.

Follow these steps to harness the power of the Debt Avalanche method.

This method is ideal for those who value long-term savings and are disciplined with numbers.

By targeting high-interest debts first, you reduce the overall cost of your debt significantly.

It requires patience, as progress might seem slow initially, but the financial benefits are substantial.

To help you decide, here's a detailed comparison of the Debt Snowball and Avalanche methods.

This table highlights their core differences, advantages, and ideal use cases.

Understanding these differences can guide you toward the method that aligns with your personality and goals.

Each method has its strengths and weaknesses, which are crucial for informed decision-making.

Here are the key pros and cons of the Debt Snowball method.

Now, let's explore the pros and cons of the Debt Avalanche method.

Weighing these factors can help you choose a strategy that fits your financial mindset.

Let's consider practical scenarios to illustrate how each method works in action.

For instance, with three $1,000 debts at 8%, 6%, and 4% interest.

The Avalanche method would target the 8% debt first, saving on interest over time.

Conversely, the Snowball method might prioritize balance order, offering quick wins if balances differ.

Here's a breakdown of debt types suited for each method.

These examples underscore the importance of aligning your strategy with your debt profile.

Selecting between Snowball and Avalanche depends on personal factors and financial goals.

Consider your personality and motivation levels to find the best fit.

If you thrive on early successes, the Snowball method might be more effective.

For those driven by numbers and savings, the Avalanche approach could be ideal.

Evaluate your debt profile, including balances and interest rates, to inform your choice.

High rate variance often favors Avalanche, while many small debts lean toward Snowball.

Consistency is key, so track progress and adjust as needed to stay on course.

Remember, both methods beat making only minimum payments, so commitment is crucial.

To deepen your debt repayment journey, explore additional topics and hybrid approaches.

Consider switching methods mid-way if your circumstances or motivation change.

Debt consolidation through personal loans or balance transfers can complement these strategies.

Historical context shows the Snowball method popularized by advocates like Dave Ramsey for its behavioral focus.

The Avalanche method roots in financial math, emphasizing efficiency and long-term savings.

Tools like spreadsheets or apps can help list and track debts, enhancing organization.

Real-world outcomes highlight that Snowball boosts completion rates through psychology.

Avalanche often leads to optimal cost savings, though studies vary on average benefits.

Potential pitfalls include variable rates or cosigners, which may require prioritization over method rules.

By integrating these insights, you can create a personalized, effective debt repayment plan.

Embrace the journey with patience and determination, knowing that every step brings you closer to freedom.

With strategic action and resilience, you can overcome debt and build a secure financial future.

References