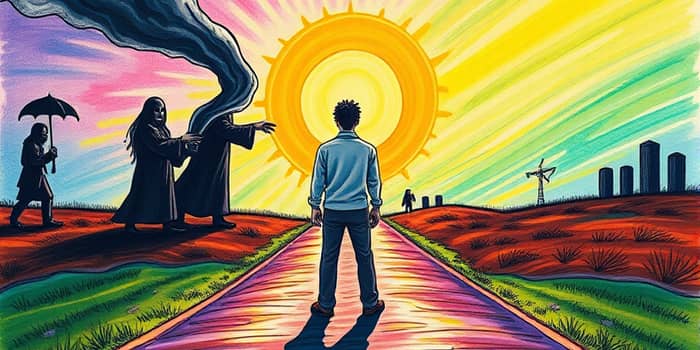

Every year, countless families and individuals find themselves trapped by loans that promise quick relief but deliver crippling debt. This article will guide you through the murky world of predatory lending and arm you with knowledge to stay safe and financially secure.

Predatory lending involves unethical, deceptive, or predatory practices by lenders who impose high-cost loans with hidden fees. These loans are structured so borrowers can’t realistically afford to repay them, pushing them deeper into financial hardship.

Often targeting those with limited alternatives—such as low-income individuals, the elderly, minorities, or people with damaged credit—predatory lenders capitalize on desperation and lack of financial education. They design products like payday loans, car-title loans, and subprime mortgages that carry hidden risks and astronomical interest rates.

While the forms of predatory loans evolve, the core strategies remain consistent: charge excessive fees, obscure terms, and trap borrowers in cycles of debt. Recognizing the most prevalent schemes can help you steer clear of dangerous deals.

Each of these products can seem like a lifeline when you need cash quickly. However, the combination of short term, high cost, and complex fine print means that most borrowers end up paying far more than they initially anticipated.

Lenders using coerce borrowers into expensive refinancing will hide key details or pressure you into signing without full disclosure. To protect yourself, stay alert for these red flags:

When lenders omit critical details or insist on rapid approval, they may be trying to push you into a product that benefits them far more than it benefits you. Always slow down, read every document, and ask questions until you fully understand the terms.

It’s easy to view predatory lending as isolated incidents, but the ripple effects can devastate personal finances, credit scores, and emotional well-being. Victims often find themselves in perpetual debt cycles, taking new loans to pay off old ones, incurring fees that outpace their ability to catch up.

Worse, when borrowers default, lenders may seize homes, vehicles, or other assets, leaving families without shelter or transportation. The stress of constant calls, legal threats, and looming repossession can lead to anxiety, depression, and a sense of helplessness.

Communities targeted by these schemes often see generational poverty deepen as equity is stripped away from those who once owned homes or cars, eroding the foundation for future stability and growth.

Empowerment begins with awareness. By understanding common tactics and maintaining a proactive mindset, you can avoid the traps set by unscrupulous lenders. Follow these steps to secure safer financing:

By taking these precautions, you can steer clear of predatory offers and choose financing that aligns with your goals. Remember that quick cash solutions often come with hidden long-term costs.

Predatory lending preys on urgency and vulnerability, crafting complex products designed to ensnare borrowers. However, knowledge is your greatest defense. Stay informed, ask questions, and always read the fine print before signing on the dotted line.

With a clear understanding of red flags, a toolkit of protective strategies, and a commitment to financial empowerment, you can navigate the lending landscape confidently and secure the funds you need without compromising your future.

References